We are now happy to provide a Research Trading Service for those who wish to take advantage of the swings for triple leveraged Exchange Traded Funds (ETFs) and have the potential of getting some terrific returns.

Track Record Speaks for Itself

As many who have been following the Current Thoughts section the last 7 months know, I have been offering plays on triple leveraged mining ETFs 5 days a week along with my take on the gold and silver markets. Some of these calls have given traders the opportunity to make over a 10% return in a short period of time and much higher returns, as much as 60%, in just a few weeks of holding. Other recommendations have been good for scalps.

Managing Trades

Not all trades will be winners. We as traders know this. What this trading service offers is how to manage trades, including trades that go against you. It will offer the best advice you can find on how to profit with patience and good timing.

You’ll also receive before each trading day the thoughts that go into the setups for each ETF and where I think we presently are as to degree of whether a particular ETF is a buy, sell or hold along with stops and thoughts on where to take profit.

This is not for the buy and hold, long term trader. You will receive information on 28 of the leveraged ETFs 5 days a week.

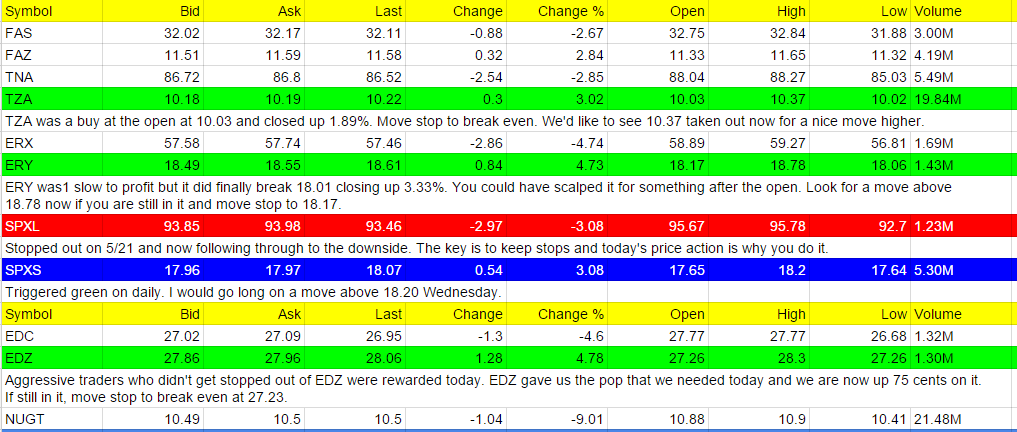

Sample of the ETF Research Trading Service from 5/26/2015

What a great day! Yesterday’s report played out to perfection (and prior feelings about a market top and a good play on TZA and others);

Here is what I said;

My feelings from the 5/21 (last report) seem to be playing out or at least they did on Friday. I didn’t have a good feeling and the stock market gave back a bit. FAS turned red and others may on Tuesday so be careful.

TZA was the new trade for Tuesday. If we do indeed get a stock market pullback, this and some of the others not yet on the radar like SDOW and SQQQ will come into play.

Look to Europe’s market to see where these ETFs may play out. It’s a tough call but a downward trend may develop.

Even gold is trending which is why we are not playing it either way just yet. As I said on 5/21, those 10% moves will come. Just be patient please.

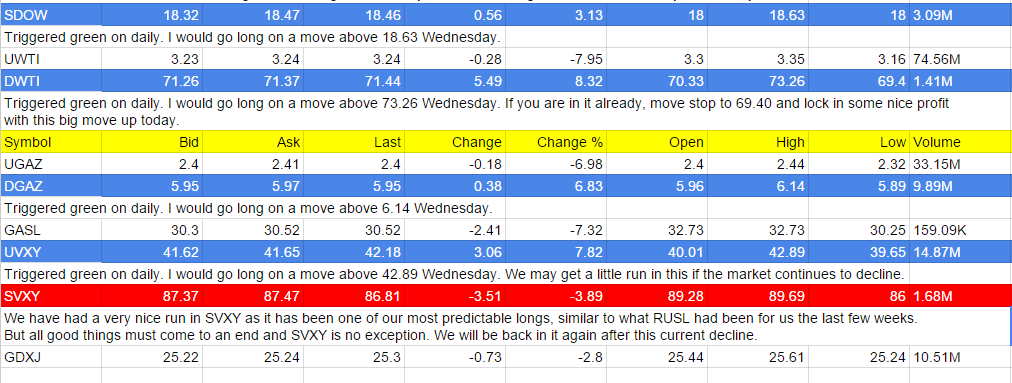

Energy is also a mixed bag and I lean towards only one trade, DWTI, but would prefer to buy it lower.

I feel a good week coming either way.

All of the blue signals below are green on the daily but have not triggered green on the weekly. Some of you may have jumped the gun on many, like DWTI, and be doing fine. I would hold until we see if we can get green on the weekly and then possibly monthly if indeed we have a reversal going on with many of these.

We had many turn red as expected and were already out of them with profit on many. SPXL, UPRO, TQQQ, UDOW and SVXY all turned red and we took some great profits from the SVXY trade.

TZA got us 1.89% today. ERY gave us over 3% if you bought at open with the break of 18.01.

RUSS triggered long on the weekly today and is a buy at the open tomorrow.

Hopefully we see many more green on tomorrow’s report.

NOTE: We are tracking more ETFs to add to the list and will be adding them sometime around the latter part of June. We have to make sure they qualify as to the parameters we set. We are trying to give you all the information and trade set ups you need to make some good profit, along with the guidance of what I see occurring in the markets.

We will also be coming out with a Free Trial of this service in the weeks ahead. Stay tuned if you are indecisive.

Great Price

Some websites are offering this service at much higher prices. We are only charging you $300 a quarter for this service at present and offering a $200 discount for an annual subscription at $1,000. If you purchase today you are locked in with the lower price for the lifetime of the service. Just one good trade each quarter and you can get your $300 subscription fee back. But our goal is to give you at least one good trade a week, not one a quarter.

How Often Will the Research Come?

The research will come to you Sunday (in preparation for Monday’s market) through Thursday, 5 days a week. It will supply you with the setups that I see each day.

My only goal is to make your trading more profitable. I believe you can acheive some very nice returns with this insight that the ETF Research Trading Service offers.

Click the button below as to which option you are interested in.