3 Short Steps to Invest in Your Future

With a Precious Metals IRA

How To Get Started With Your IRA Investment

- You will have to set up your precious metals self-directed IRA with a custodian. There are several to choose from and you’ll find their information below.

- Once the IRA has been set up, you can contribute to a new IRA or transfer funds from the current institution by completing a rollover/transfer form to the new custodian.

- Once funds are transferred, you will need to give us a call at 888-604-6534 to purchase the approved metals for your account. We will lock in the price and provide all further instructions to complete the transaction. Your custodian will settle the trade and Buy Gold and Silver Safely will have the metals shipped to your IRA account.

Call 888-604-6534 Today and Speak to an IRA Consultant

THE ENTRUST GROUP

555 12th Street #1250

Oakland, CA 94607

Toll Free: 877.545.0544

Fax: 775.850.9118

GOLDSTAR TRUST

P.O. Box 719

Canyon, TX 79015

Toll Free: 800.486.6888

Fax: 806.655.2530

www.goldstartrust.com

GoldStar Trust Application

KINGDOM TRUST COMPANY

1105 State Route 121 N

Suite B Murray, KY 42071

Toll Free: 888.753.6972

Fax: 270.226.1001

https://www.kingdomtrust.com

STRATA TRUST COMPANY

7901 Woodway Drive, Suite 200

Waco, TX 76712

Toll Free: 866.928.9394

Fax: 512.495.9554

What Metals Are Allowed in Your Self-directed IRA?

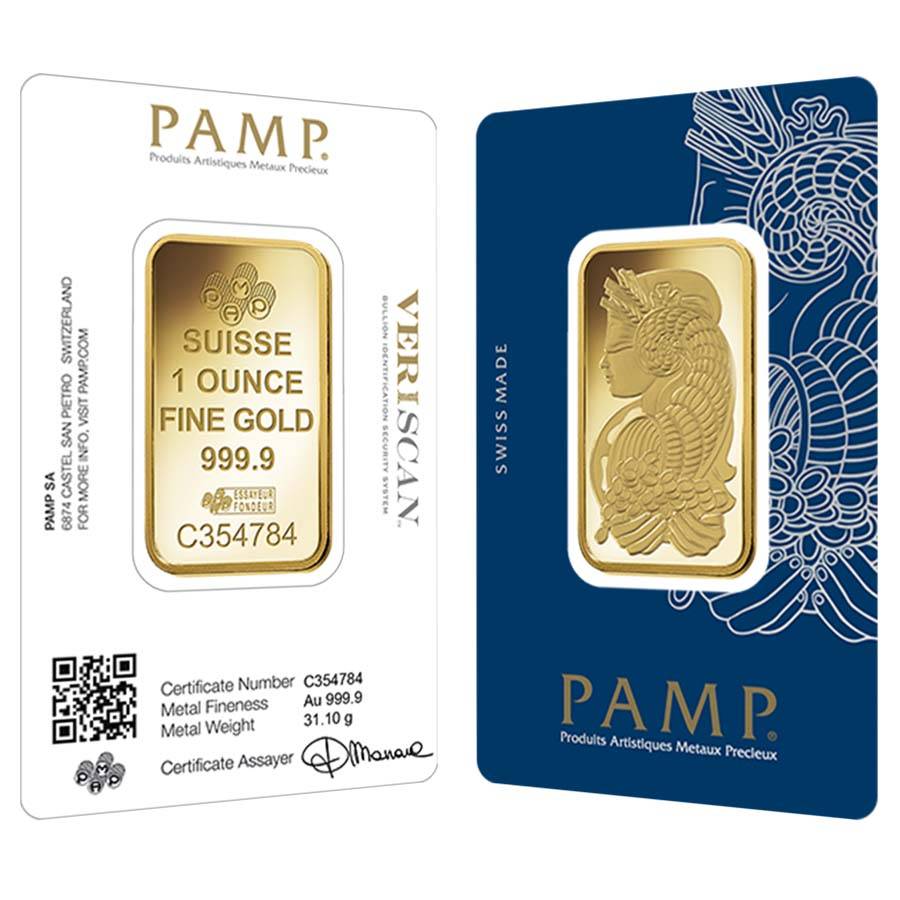

- Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure.

- Bars, rounds and coins must be produced by a refiner, assayer or manufacturer that is accredited/certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum fineness requirements.

- Proof coins must be encapsulated in complete, original mint packaging, in excellent condition, and include the certificate of authenticity.

- Small bullion bars (other than 400-ounce gold, 100-ounce gold, 1000-ounce silver; 50-ounce platinum and 100-ounce palladium bars) must be manufactured to exact weight specifications.

- Non-proof (bullion) coins must be in brilliant uncirculated condition and free from damage.

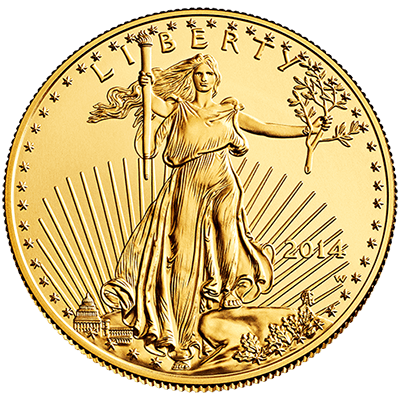

Examples of Acceptable Gold Products

American Eagle bullion and/or proof coins (see more on proof coins below as we do not recommend them)

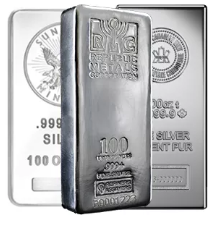

Examples of Acceptable Silver Products

Examples of unacceptable precious metal products:

| Any rare or collectible coin | Chilean Peso | Hungarian Korona |

| Austrian Corona and Ducat | Columbian Peso | Italian Lira |

| Belgian Franc | Dutch Guilder | Mexican Peso and Onza |

| British Brittania (pre-2013) | French Franc | South African Krugerrand |

| British Sovereign | German Mark | Swiss Franc |

What to Watch Out for When Investing in a Precious Metals IRA

There are several scams out there gold dealers push upon unsuspecting investors. Please do not fall prey to their tactics which I have warned about in my book Buy Gold and Silver Safely.

1. No, you cannot take physical possession of your metals at home.

Gold and other bullion are “collectibles” under the IRA statutes, and the law discourages the holding of collectibles in IRAs. There is an exception for certain highly refined bullion provided it is in the physical possession of a bank or an IRS-approved nonbank trustee. This rule also applies to an indirect acquisition, such as having an IRA-owned Limited Liability Company (LLC) buy the bullion. IRA investments in other unconventional assets, such as closely held companies and real estate, run the risk of disqualifying the IRA because of the prohibited transaction rules against self-dealing. Source: https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-investments

2. Don’t Buy Proof Coins

In March of 2013, as well as in the first version of my book in 2010, I warned investors about how gold dealers push them to buy gold and silver proof coins and sets in their IRA. These dealers typically charge a 15% to 30% commission and try to categorize these metals as having a collectors value that will appreciate faster than bullion. There is no proof of this. These coins are basically shiny, pretty bullion coins that have had an extra polishing to them.

Here is the article I wrote for Seeking Alpha on the subject; The Problem With Buying Gold And Silver Proof Coins In Your IRA